The possibility of propane supply challenges this winter is real. Revisiting your supply plan and pricing strategies now can help you minimize supply risk and avoid costly premiums during seasonal price spikes.

“We’re coming into the winter season with the lowest fall propane inventories seen in the last five years,” says Dennis St. Aubin, CHS Propane western sales director. “Current inventories are about 20 percent below the five-year average. That market factor, coupled with both growing global demand as manufacturing rebounds from the COVID-19 pandemic and the typical high domestic winter demand, sets us up for potential propane supply and pricing challenges in the months ahead.”

The Upper Midwest may start the winter season with a colder-than-average December, according to a prominent weather model, which projects 829 heating degree days (HDD), compared to 796 last December and the 10-year average of 786 HDD for December.

“It’s important that retailers act now to update their supply plans to try to stay ahead of these looming market factors,” says St. Aubin.

Plan now to avoid wet premiums

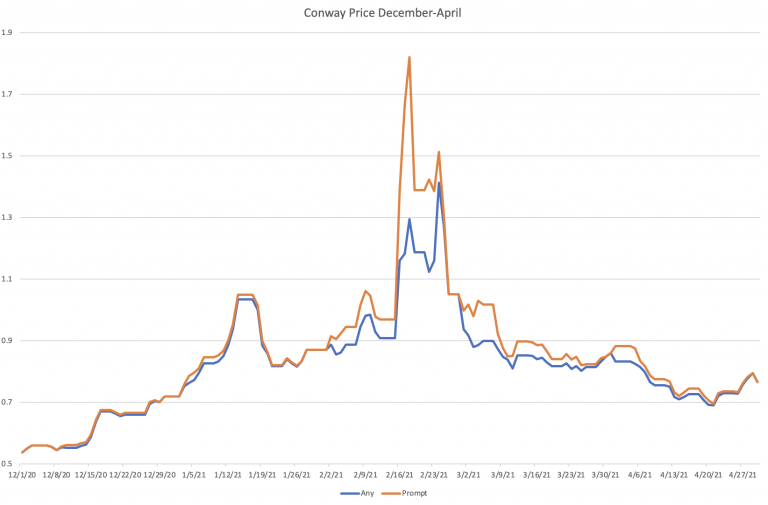

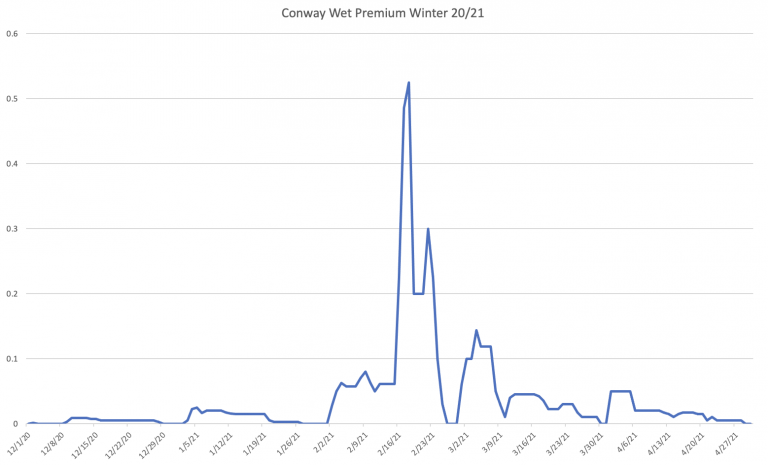

Last February’s severe cold snap into the southern United States serves as a lesson on how quickly the propane supply system can get slammed, he notes. “The big storm and frigid cold across much of the country caused propane demand to jump, and the infrastructure was challenged to meet that demand. Suppliers had to increase the number of prompt gallons being put into the system, prices spiked and wet premiums appeared.”

What exactly is a wet premium? In the propane industry, a wet premium represents the separation between the “any current month” price of propane versus the “prompt current month” price, explains St. Aubin. “During times of tight supply, barrels purchased on an any basis are not delivered until the end of the month. If you specifically need gallons prior to the end of the month, you need to pay an increased prompt price for near term delivery in times of tight supply. The prompt price can become a lot more expensive than the any price.” When the two values diverge, it creates a wet premium.

A good strategy for minimizing such price risk is to price presold gallons ahead of the month that they’re needed, which helps reduce the risk of hub values spiking, he says. “If your risk strategy has been to purchase indexes, it may be in your best interests to fix a hub value on gallons ahead of the month you plan to lift them. This will minimize the risk of, or even prevent, lifting wet premium gallons.

“It’s also important to review terminal positions daily leading up to and throughout the busy winter season,” he adds. “Watch

for key industry developments, including natural gas curtailments due to cold weather, which usually lead to sharp increases in propane demand.”

Tools to help manage risk

There are a variety of tools and mechanisms available to help retailers refine both supply and price risk management. St. Aubin

offered the following tips for supply and price planning.

Frequently update your plan.

Regular review and revision to your supply plan is crucial to staying on top of the markets and ensuring adequate supplies. The CHS Propane Control Room is a convenient supply planning tool that simplifies the process.

Communicate with suppliers.

Good communication is a two-way street and, in order to help customers meet their goals and secure adequate and timely propane supplies, your account manager needs to be connected and working with you in real time. This way, they can react, or hopefully stay ahead, of market developments and regional supply issues.

Diversify supply sources.

Use multiple terminal options, including pipelines, rail terminals and gas plants, if available. This provides flexibility in dealing with unexpected infrastructure problems.

Seek out market intelligence.

Reliable suppliers are a good source of market intelligence and industry insights. CHS offers a free Texting Tool that delivers up-to-the-minute information on propane pricing and terminal updates. You can sign up for this timely intelligence source in the CHS Propane Control Room. Another great online source is the daily Market Pulse bulletin provided by CHS Propane.

Propane marketers should work with their CHS account managers for help with tracking industry trends and updating their supply plan to incorporate these strategies for reducing risk and meeting procurement needs.

“Your CHS Propane account manager is looking out for your best interests,” adds St. Aubin. “Working with our organization puts a wealth of market knowledge and industry expertise at your disposal.”

To learn more about partnering with CHS Propane, visit CHS Propane Insights or call 1-800-852-8184.