Over the last three years, U.S. propane inventories have bounced back a bit from the lows hit in late 2021, but that shouldn’t lull propane retailers into a false sense of supply security.

“It’s true that U.S. propane production continues to grow at a healthy pace,” says Tyler Kelly, CHS director of propane trading. “It was up by about 4.5 percent in 2024 and is projected to increase by 3.5 percent in 2025, but global demand and U.S. exports are also expected to continue to grow.”

More comfortable domestic inventories and stable prices in 2024 resulted in a lighter-than-usual winter-fill buying season, he notes. “The trading range last summer was a narrow 18 cents, which was unusually tight, reflecting a level of stability we hadn’t seen for a while.”

But the arrival of winter brought a return of market volatility, he adds. “Winter liftings were strong and, with colder-than-normal temperatures across many parts of the country which has pulled overall U.S. supply back below 5-year seasonal levels.”

Retailers with a sound supply plan in place can more quickly adjust to winter demand spikes, says Kelly. “It pays to work closely with your propane supplier to evaluate additional storage needs and develop a plan that helps you hedge against both price and supply risk.”

Learn more about evaluating your current storage capacity and optimizing it for future supply flexibility.

Five factors to consider

Both types of risk have taken on new meaning in recent years as global propane demand increases and U.S. producers build more export infrastructure.

“There are plenty of global unknowns and domestic factors that could impact export demand in the year ahead, including inflation, new developments in the Middle East and Ukraine conflicts and tariffs on U.S. imports,” says Travis Dunham, CHS director of propane supply. “Most indicators point to continued strength in export markets in the coming years,” he adds.

Dunham and Kelly offer these recent statistics that support this outlook and help illustrate why global markets will continue to keep pressure on domestic inventories.

1. U.S. production has doubled in the past decade but domestic demand has flattened.

U.S. propane production has been on a steady increase since 2012, when the industry produced 1.25 million barrels per day (bpd). In 2024 the U.S. more than doubled that volume, reaching 2.65 million bpd. Over that same period, domestic demand has remained in a stagnant range, influenced by weather.

2. In 2024 65% of total U.S. production was exported.

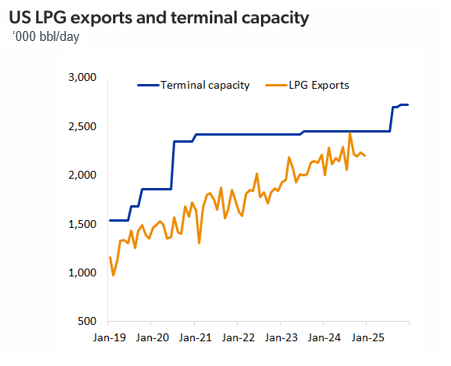

Thanks to major investments in propane infrastructure over the past five years, including new pipelines and export terminals, U.S. exports have jumped from an average of 1.35 million bpd in 2022 to 1.75 million this past year. In 2021, after the first major phase of infrastructure expansion had occurred, exports averaged 52% of total U.S. production. By 2024, that number had jumped to 65%.

3. New pipelines provide export access to the Midwest.

Initial growth in U.S. LPG exports came primarily from Gulf Coast producers, but inter-regional pipeline projects have now connected parts of the Midwest with hubs at Conway, Kansas, and Mt. Belvieu, Texas. “Producers as far north as the Bakken oil fields in North Dakota, now have more marketing options, including exporting,” says Dunham. “Midwest retailers can no longer assume regionally produced propane supply is a given.”

4. U.S. exports have nearly reached capacity of the current infrastructure.

Short term, propane exports are constrained by maximum capacity limitations. Export terminal operators have responded, however, as several major export infrastructure expansions are in the works. When completed in 2025 and 2026, three new Gulf Coast projects will increase current export capacity by 30% as planned expansions by Energy Transfer (+0.25 million bpd), Targa (+.03 million bpd), and Enterprise (+0.3 million bpd) bolster existing infrastructure.

5. China’s demand already outpaces total U.S. demand.

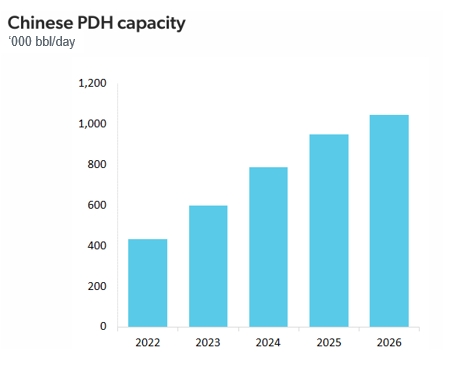

The world’s fastest growing demand for propane is from China, where new PDH (propane dehydrogenation) plants continue to increase the nation’s appetite. After the construction of a number of newly commissioned plants, the PDH sector’s propane demand base now exceeds the total of residential, commercial, and agricultural demand in the U.S. The need for plastic packaging has continued to grow in recent years and so has demand from petrochemical producers, who use resin from natural gas products like propane to make plastics. China has been opening new petrochemical plants in the past few years, with more to come.

Update your plan

No one can predict all the effects of global and domestic factors on the propane market but developing and regularly revising a supply plan can help retailers reduce risk, especially during crunch times in the season.

“It is valuable to review any changes to your business, at least on a yearly basis, to accommodate weather-related differences from one year to the next, growth or changes in your regional markets, and the need for additional storage,” says Kelly. “By working closely with your propane supplier, you can be ready for multiple market and weather scenarios, and best leverage your supply options and the resources they offer.”

Your CHS account manager can help with your supply plan. To begin partnering with CHS Propane, visit CHS Propane Insights or call 1-800-852-8184.

Leave a Reply