Over the past decade, U.S. propane production has more than doubled, but propane exports have increased nearly tenfold. The impacts of that latter trend were felt this summer in the form of lower-than-average domestic inventories and the highest August propane prices since 2011.

Several developments earlier this year have compounded the impact of those trends, says Ben Lyden, CHS director of trading and risk for NGLs. “A start to recovery in global manufacturing and trade after the 2020 COVID-19 pandemic slowdown has sparked renewed demand for propane from countries including Japan and China. Last February’s cold snap across the southern United States caused natural gas prices to skyrocket and drew down propane inventories even further.

“The result is that we’re now facing propane supply challenges across the country, and especially in the Midwest, as we move into the fall and winter seasons,” he says. “It’s important to update your supply plan to reflect this reality.”

Low U.S. inventories

The U.S. is going into the coming winter season with some of the lowest inventories seen at this time of year in the last five years — specifically less inventory than one year ago. “If we have demand equal to or better than last year through the fall and winter months, there won’t be enough physical gallons in certain regions,” Lyden says.

The Midwest in particular is seeing inventories well below those of the last five years. Gulf Coast inventories have also been low this summer and, when supplies get tight there, that region is likely to pull from other regions, including Conway in the Midwest, which could further exacerbate regional logistical constraints, according to Lyden.

Another important propane metric to watch is the U.S. days of supply level, which dropped below the 20-day level back in July and has been at the lowest levels in the past five years for much of this past summer.

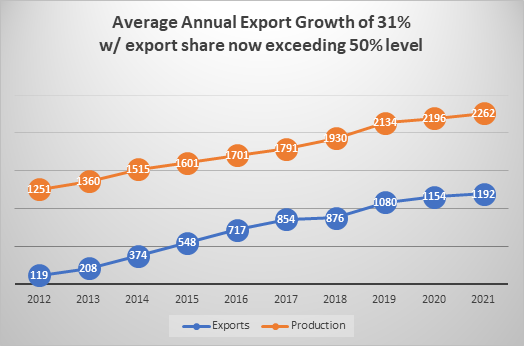

Continued strong exports

“The global economic recovery we’ve started to see this year, after the impacts of the pandemic in 2020, has had a positive impact on U.S. propane export demand,” says Lyden. “Some of the biggest demand growth has come from China, which is a bit of a black hole for future LPG demand with all of its manufacturing and processing.”

LPG demand in that country has quadrupled in the last decade, he notes. “Even over this past year, when demand dropped from most other U.S. export markets, demand from China increased 6%.”

Currently, the U.S. leads the globe in LPG net export tons, with the next closest exporters Qatar and the United Arab Emirates each exporting less than half of what the U.S. shipped abroad. “With as much as two-thirds of U.S. propane now being exported, the U.S. domestic market will need to compete for those gallons and keep them here for winter demand season,” adds Lyden.

Best supply strategies

Lyden says U.S. propane buyers will have to earmark contracted gallons sooner than usual in order to ensure supply is there when they need it this fall and winter. “If you don’t have physical gallons in place or don’t have them contracted, you should expect to pay wet premiums similar to or even higher than those paid last winter, which were 50 to 60 cents per gallon.”

While the contracted gallon provides the earmark on the gallon, your rack supply plan is a forecast and should be revisited with your wholesaler to position sufficient gallons, which is critical for the season ahead.

There are other valuable supply risk management strategies to consider as well:

- Right-size tanks. Now is a good time to reassess your storage volumes, says Lyden. “If you have storage that holds only a few days of supply, consider investing in additional storage so you have enough to make it through a crunch time. It’s a good way to reduce supply risk.”

- Know your terminal options. Maintaining reliable supplies might mean looking at alternative terminal options. “This is where your CHS account manager can provide regional insights and logistical expertise,” notes Lyden.

- Consider transportation tightness. Truck drivers are in short supply in many parts of the country, and the shortage is often felt the most during peak demand times like fall. That’s why Lyden recommends maintaining good relationships with carriers and including transportation considerations in your supply plans. “There can be plenty of gallons at a terminal, but it won’t matter if you can’t get it transported to the customer.” As you consider your transportation needs, remember to get carriers carded ahead of the busy season. Help prepare for this season by having your carrier schedule terminal driver training before the October/November season arrives. This process ensures drivers are qualified to load at the necessary terminals and avoids impacting the terminal and operators if training occurs during the busy time of year.

Propane marketers should work with their CHS account managers for help with the supply plan process and to make sure they have alternative fuel sources for the winter season ahead. Those interested in partnering with CHS Propane can learn more by visiting CHS Propane Insights or by calling 1-800-852-8184.